Chicago high interest loans target black neighborhoods

Pointing out that high interest loans are proliferating in Chicago’s non-white neighborhoods is a bit like saying the skies are blue or the grass is green, but a consumer group says he’s proving it for the first time. times with precise numbers.

Using 2019 borrower loan data obtained from state regulators, the nonprofit Woodstock Institute found that the main zip codes for payday loans, except for the loop, were predominantly black, including:

- 60619 and 60620 on the south side, which include parts of Chatham, Burnside, Avalon Park and Greater Grand Crossing, Auburn Gresham and Washington Heights. These zip codes had over 16 payday loans per 100 people and are both 95.7% black.

- 60624 on the West Side, which includes parts of West Garfield Park, East Garfield Park and Humboldt Park and had 15.8 payday loans per 100 people. This postal code covers an area 90.7% black.

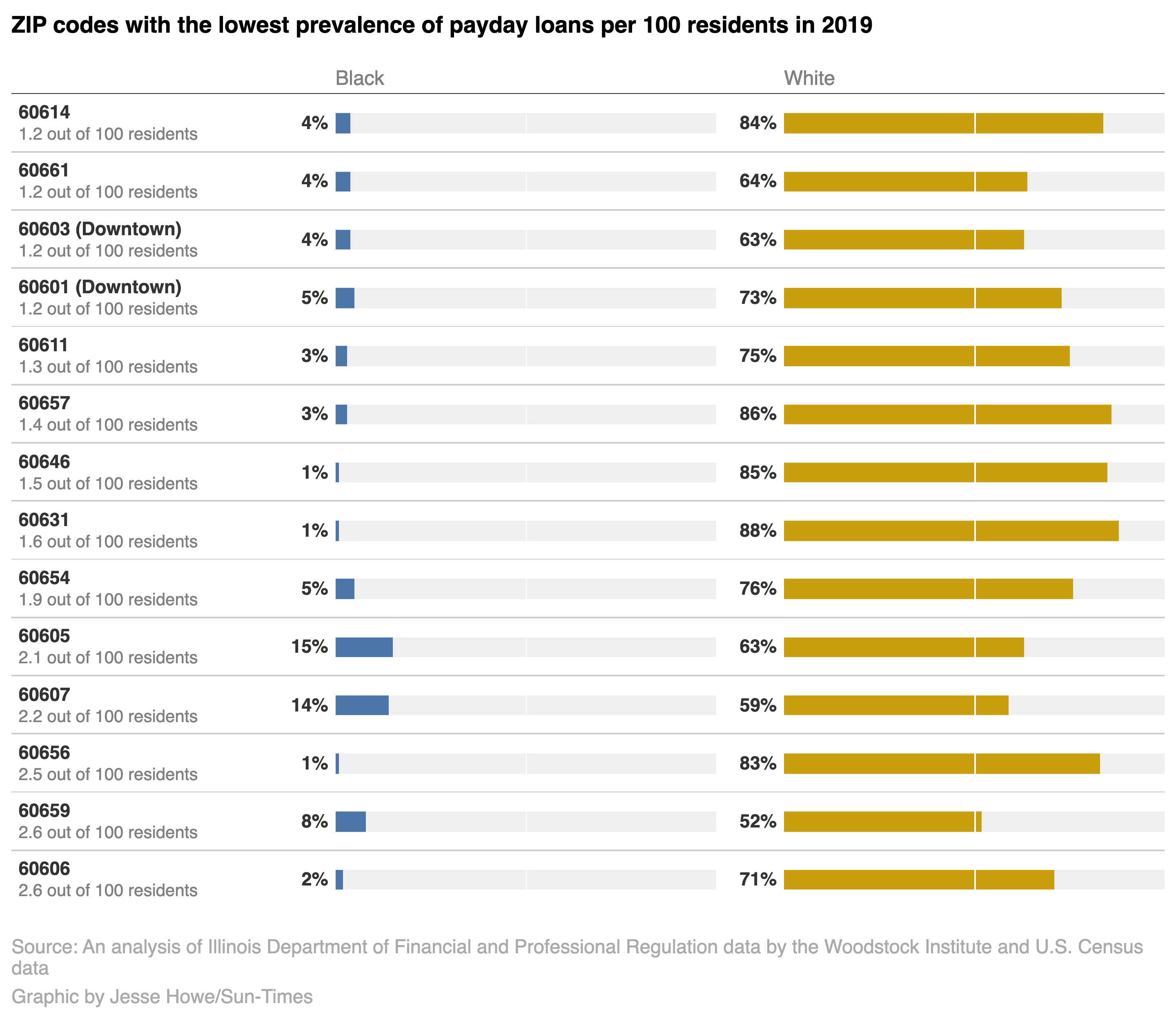

In contrast, the postal codes with the lowest incidence of payday borrowers were mostly white, such as 60614 in Lincoln Park. This area had 1.1 payday loans per 100 people in an 84% white zip code.

The analysis included zipcode data for borrowers with payday loans and installment loans, which largely disappeared on March 23, when a new interest rate cap took effect in the Illinois. The nonprofit group obtained the data through an application for registration with the Illinois Department of Financial and Professional Regulation.

Data for 2020 – although an odd year for loans due to the COVID pandemic – was similar, with the two major zip codes 60619 and 60620, followed by 60628, which covers parts of Roseland, Pullman, West Pullman and Riverdale, and that is 93.1% black.

Brent Adams, senior vice president of the Woodstock Institute and director of the IDFPR under former Governor Pat Quinn, called it “statistical significance on steroids.”

“These loans very specifically target black communities,” Adams says, adding that high interest loans perpetuate a status quo “that is riddled with racial and economic inequities.”

-no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23039090/Headshot_2019.jpg)

Studies have shown that black Americans have an average net worth of about a tenth that of white Americans, in large part due to past discriminatory practices that have hampered the accumulation of family wealth, including the denial of mortgages.

The industry claims that it provides a necessary service for people who do not have a credit history or collateral to qualify for traditional bank loans.

In Illinois, as of March 23, payday loans, title loans and installment loans must meet a 36% cap on the annual percentage interest rate. The Illinois Predatory Loan Prevention Act also requires vehicle financing to meet the cap.

Tiffany Moore of Forest Park first turned to an installment lender when the coronavirus hit and a tenant in her investment property couldn’t pay rent. His loan, of $ 9,500, had a term of five years and an interest rate of 35.989%.

Even with a rate below 36%, she found that she would pay back more than double what she had borrowed. So Moore paid him off earlier.

“I was like, I have to get rid of this,” she said. “How can you move forward if they charge all this interest?” “

-no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23039129/WATCHDOGS_11262021_6.jpg)

Ed D’Alessio, executive director of INFiN, a business group that includes low dollar lenders, says Woodstock’s analysis is “nothing more than a distracting thought experiment. of the real challenges facing borrowers today ”.

D’Alessio says many borrowers are “underserved, overlooked or left behind by other financial institutions.”

The 36% cap has already caused some payday and low dollar lenders to close their locations in Illinois, he says.

Samantha Carl of Palatine says the storefront lender she used in the suburbs has since closed. She got a loan of $ 700 before the 36% cap which had an APR of 399%. She paid it off in a few months, but it still cost her around $ 1,200, she says.

“It helped me when I needed it, but the interest rate is crazy,” says Carl, who relies on monthly disability checks and has undergone auto repair.

Ed McFadden, spokesman for the American Financial Services Association, which represents installment lenders but does not include payday lenders or auto lenders, said the new law could have unintended consequences.

It points to a 2015 Federal Reserve investigation in which lenders said they could not break even on loans below $ 2,532 at an APR of 36%.

“Rate caps may make policymakers and interest groups feel good about themselves, but it leaves many consumers who are already struggling in a credit desert,” he says.

But Adams says there are alternatives, such as the Capital goods fund, which lends to “unbanked” consumers and charges a average interest rate of 13%.